China’s Trade in IT Products: Variety, Scale, and Economic Gains

February 6, 2013

Introduction and Testable Hypotheses

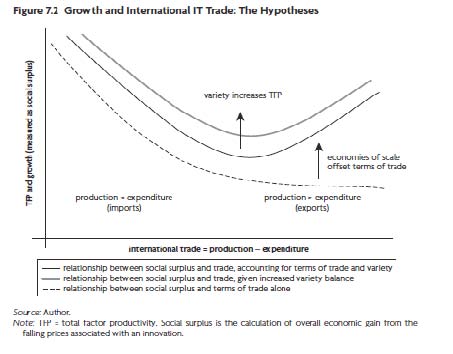

Globalization of information technology products (IT) relates to economic growth through three channels:

(1) Terms of trade. The fall in quality-adjusted prices of IT products favors use of IT in the domestic economy and yields TFP gains.

(2) Economies of scale. Total factor productivity is positively associated with the scale of production of IT products.

(3) Variety. Greater variety means that more domestic users find good matches between products and needs, which increases productivity and growth. Greater variety and uniqueness of exports is associated with increased prices and profits.

Figure 7.2 reproduced from the Chapter sets out these three factors in terms of an integrated hypothesis relating TFP and trade in IT products.

Empirial analysis using a sample of 36 countries for 2000-2007 finds:

(1) With regard to terms of trade, importers of IT gain relatively more than exporters, on average, from the declining prices of IT coming through international trade.

(2) With regard to economies of scale, despite falling IT prices, most exporters enjoy positive economy-wide benefits of trading in IT because of economies of scale in production.

(3) With regard to variety, countries with greater variety tend to experience greater TFP gains relative to those with less variety. Against this backdrop and empirical validation, where does China fit in?

China’s gains from IT trade

China’s participation in global trade in IT products exploded over the 1990s and 2000s. From 2% of global exports in 1990, China+ (China plus Hong Kong SAR) rose to 15% of global exports (ranked 1st) in 2004. On the import side, China+ moved from 9th ranked at 4% of global imports to top ranked with 20% of global imports. In terms of importance in global expenditure on IT, however, China+ both grew less and is less important. China+’s share of global expenditure, although it rose four times over and ranks sixth in global expenditure at 3%, remains quite small in comparison to the country’s importance in global trade.

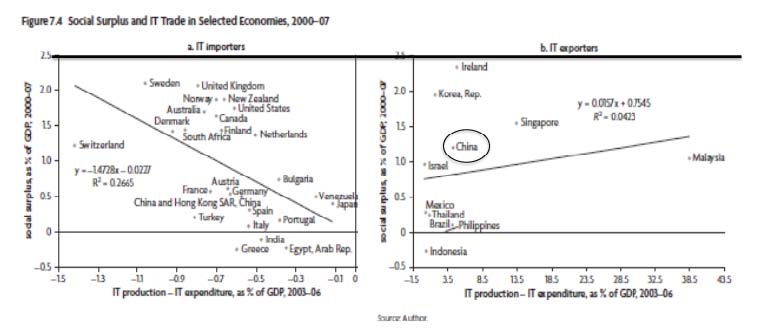

Putting the data on trade prices, and production and expenditure into the framework reveals a pattern similar to what was hypothesized (Figure 7.4 from the Chapter replicated below). Increased imports of IT products (left panel) is associated with greater economic gains as measured by the social surplus concept, a concept that is isomorphic to TFP. This is consistent with other findings on the relationship between IT use and TFP in the domestic context.

For IT exporters (right panel), the relationship could be positive (if economies of scale gains outweigh terms of trade losses) or negative. Since the trend line cuts the y-axis at around 0.76%, it appears that a country does gain from being a producer and exporter; but the simple correlation coefficient of 0.016 suggests that there is not a strong relationship between the magnitude of exports and economic gain.

China, as an exporter, lies above the regression line, suggesting that it gains relatively more from its pattern of trade, production, and expenditure compared to other net exporters. The story for these relatively greater gains for China, despite being an exporter, pretains to the variety of China’s products in trade.

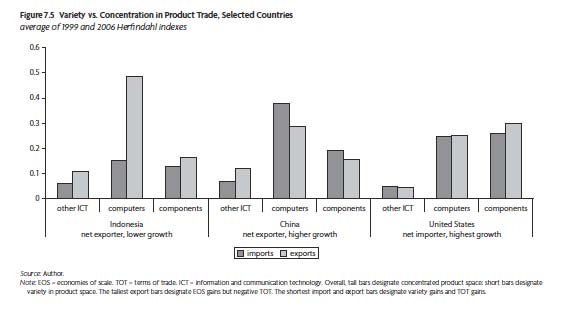

Variety can be measured in several ways; this paper uses the Herfindahl (H) index calculated across 178 different varieties of IT exports and imports allocated into broader product categories, including Computers, Components, and Other ICT (embedded ICT such as medical devices). Within a category, a Herfindahl close to 0 implies a high variety in product trade, and Herfindahl close to 1 implies highly concentrated product trade.

Figure 7.5 from the Chapter shows Herfindahl indexes for three countries and three product categories. Returning to Figure 7.4, Indonesia is an exporter with lower than average social surplus for exporters (lies below the trend line for exporters). It has a very high concentration of trade in Computer exports. With a highly concentrated export pattern, but lower than average social surplus, this suggests that economies of scale in production does not outweigh the terms of trade effect, and, with high concentration, there are no gains from variety.

China is also a exporter, but with higher than average social surplus (lies above the trend line in Figure 7.4) for exporters. Although China’s exports of Computers are somewhat concentrated, it has an even greater concentration in imports of Components. Therefore, China may achieve higher than average economic gain by importing and getting the benefits of the terms of trade on Components. And, with high variety (low H) in exports of Other ICT, China may gain from market power in trade, with attendent benefits of higher prices and profits.

This short paper draws on Chapter 7, “Information Technology, Globalization, and Growth: Role for Scale Economies, Terms of Trade, and Variety”, in Otaviano Canuto and Danny Leipziger, eds 2012. Ascent after Decline : Regrowing Global Economies after the Great Recession. © World Bank . https://openknowledge.worldbank.org/handle/10986/2233

Catherine L. Mann

Barbara ’54 and Richard M. Rosenberg Professor of Global Finance

International Business School, Brandeis University

Visiting Scholar, Federal Reserve Bank of Boston

![]()

![]()